To read a check, look at the date, payee, amount, and signature. Make sure the amount written in numbers matches the amount in words.

Reading a check may seem daunting, but it’s an essential skill for managing personal finances. Understanding how to read a check ensures that the right amount is being paid to the right person or organization. The process begins by examining the date, payee, and amount.

The date is important because it indicates when the check was written and when it can be deposited. The payee is the person or organization that the check is made out to. Next, verify that the amount written in numbers matches the amount in words. This ensures that the correct amount is being paid. Lastly, check for the signature of the account holder as it is required for the check to be valid. By following these steps, anyone can confidently read and understand a check.

Deciphering The Front Of A Check

When it comes to handling financial transactions, it’s essential to have a clear understanding of the information presented on a check. The front of a check contains vital details that provide valuable insights into the transaction. By deciphering these elements, you can ensure accuracy and security in your financial dealings.

Personal Information: Whose Account Is It?

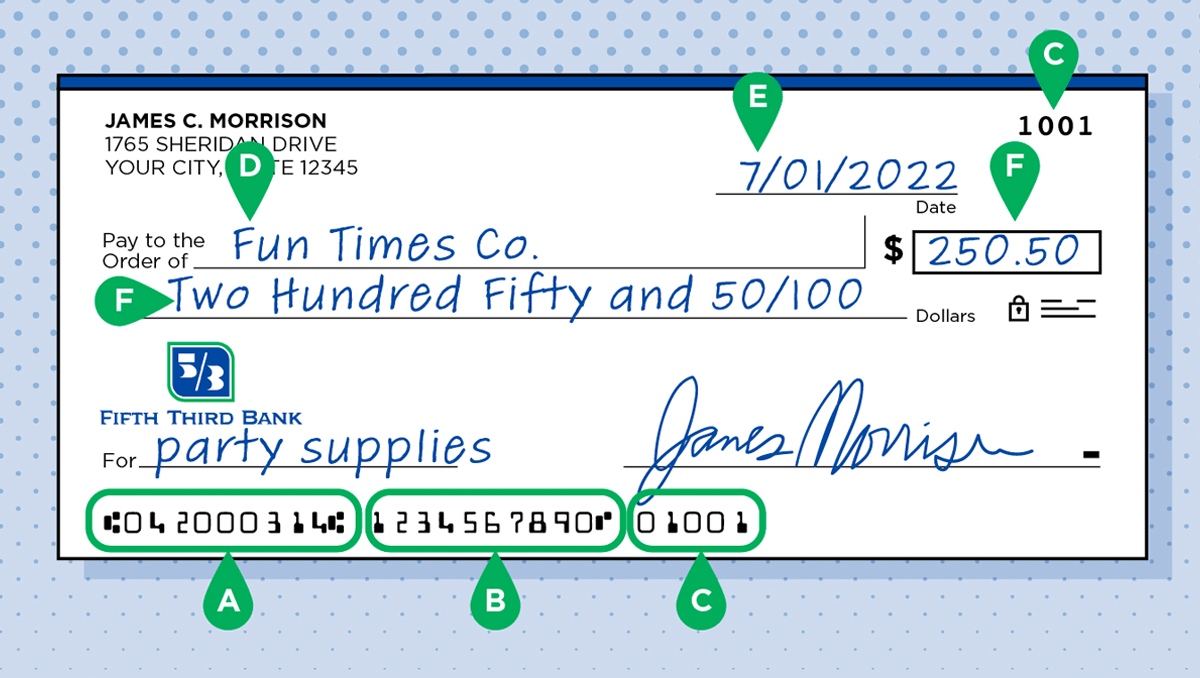

At the top left corner of a check, you will find important personal information, including the account holder’s name and address. This section confirms whose account the check is drawn from, giving you the confidence that the payment is being made by the correct individual or entity.

Payee Line: Who Is Receiving The Money?

Directly below the personal information, you will see the payee line. This line designates the recipient of the funds. It is crucial to ensure that the name written on the payee line matches the intended recipient. This prevents any confusion or potential errors in the payment process.

Numeric Amount Box: Understanding The Digits

The numeric amount box, located on the right-hand side of the check, represents the payment amount in numerical form. It is essential to carefully review this section to confirm the accuracy of the payment. Ensure that the amount matches the intended payment, avoiding any discrepancies or mistakes.

Written Amount: Confirming The Payment In Words

Below the payee line, you will find the written amount section. This area presents the payment amount in words, providing an additional layer of verification. It is crucial to carefully examine this section to confirm that the written amount matches the numeric amount, eliminating any potential errors or fraudulent alterations.

Memo Line: Identifying The Payment Purpose

The memo line, located at the bottom left corner of the check, allows the payer to provide additional details regarding the purpose of the payment. This section is optional but can be helpful in identifying the payment’s intent, such as referencing an invoice or providing specific instructions. Reviewing the memo line ensures that the payment aligns with its intended purpose.

In conclusion, deciphering the front of a check involves understanding the personal information, payee line, numeric amount box, written amount, and memo line. By carefully examining these elements, you can ensure the accuracy and legitimacy of the transaction, providing peace of mind in your financial interactions.

Understanding The Check Number

When it comes to reading a check, understanding the check number is an essential aspect. The check number serves as a unique identifier for each check and plays a crucial role in tracking and managing your finances. In this section, we will explore the location and purpose of the check number, as well as why it is important to keep track of your checks.

Location And Purpose Of The Check Number

The check number can typically be found in the top-right corner of the check, often next to the date. It is usually a series of digits printed in a smaller font compared to other information on the check. The purpose of the check number is to provide a reference point for both the issuer and the recipient of the check.

From a practical standpoint, the check number helps in organizing and identifying checks when reconciling bank statements or searching for specific transactions. It serves as a unique identifier that distinguishes one check from another, ensuring accuracy and efficiency in financial record-keeping.

Tracking Your Checks: Why It Matters

Tracking your checks may seem like a mundane task, but it holds significant importance for your financial management. Here are a few reasons why keeping tabs on your checks is essential:

- Budgeting: By monitoring your check usage, you can gain a better understanding of your spending habits and adjust your budget accordingly.

- Preventing Fraud: Regularly tracking your checks allows you to detect any unauthorized transactions or suspicious activities, helping you safeguard your financial accounts.

- Reconciliation: When reconciling your bank statements, having accurate check records simplifies the process and ensures that all transactions are accounted for.

- Tax Purposes: Tracking your checks can be beneficial during tax season, as it provides a clear record of deductible expenses and payments made.

Overall, understanding the check number and actively tracking your checks empowers you to maintain control over your finances, avoid potential issues, and make informed financial decisions.

Date Line: When The Check Was Issued

The date line on a check indicates when the check was issued. It is an essential piece of information for processing banking transactions and ensuring the validity of the check.

Importance Of The Date For Banking Transactions

The date on a check is crucial for banking transactions. It determines the time frame within which the check can be cashed or deposited. Banks use the date to establish the check’s validity and to prevent the cashing of stale-dated checks.

Post-dated Checks: Future Payments

Post-dated checks are checks with a future date. They are used to authorize future payments and cannot be cashed or deposited until the date specified on the check. It’s important to note that banks may process post-dated checks before the specified date if the payee attempts to cash or deposit them early.

Credit: www.gobankingrates.com

Signature Line: Authorizing The Transaction

When you receive a check, the signature line plays a crucial role in authorizing the transaction. It serves as a validation of the check and signifies the individual’s consent to the payment. Understanding the significance of the signature line is essential in accurately interpreting the legitimacy of a check.

The Role Of The Signature In Verifying A Check

Upon receiving a check, the signature serves as a critical component in verifying its authenticity. It acts as a form of authentication, confirming that the individual has approved the transaction. By analyzing the signature, financial institutions and businesses can ensure the check’s validity and legitimacy.

Forgery And Fraud: Why A Signature Matters

The presence of a signature is vital in deterring forgery and fraud. A valid signature provides a level of security, making it more challenging for unauthorized individuals to manipulate or misuse the check. Without a genuine signature, the risk of fraudulent activity significantly increases, emphasizing the importance of the signature in safeguarding financial transactions.

Bank Information And Check Routing Number

When reading a check, understanding the bank information and routing number is crucial. This section will guide you through locating the issuing bank and understanding the routing number, ensuring your money is directed to the right place.

Bank’s Name And Address: Locating The Issuing Bank

Locating the bank’s name and address on a check is essential. This information is typically found at the top-left corner of the check. It includes the name of the bank and its physical address. Here’s a breakdown:

- Look for the bank’s name printed on the check.

- Below the bank’s name, you’ll find the physical address of the bank branch that issued the check.

- This information is important for verifying the legitimacy of the check and contacting the bank if necessary.

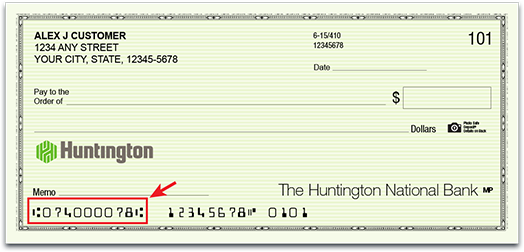

Routing Number: Guiding Your Money To The Right Place

The routing number is a key element when processing checks. It directs the money to the correct financial institution during electronic transactions. Here’s how to understand and use the routing number:

- The routing number is a 9-digit code typically found at the bottom-left corner of the check.

- It identifies the specific bank and branch where the account is held, ensuring the money reaches the right place.

- When setting up direct deposit or making electronic payments, you’ll need the routing number to ensure the funds are directed accurately.

Credit: www.huntington.com

Account Number: Identifying Your Account

Understanding your account number is crucial for financial transactions. It uniquely identifies your bank account and is required for various banking activities.

Where To Find Your Account Number

Your account number is typically located at the bottom of your check. Look for a series of numbers often accompanied by symbols. It is essential for initiating direct deposits, wire transfers, and setting up automatic payments.

Keeping Your Account Number Secure

Protecting your account number is vital to prevent fraud and unauthorized transactions. Avoid sharing it with unknown individuals and keep your checks in a secure place. Be cautious while providing it over the phone or online.

Micr Line: The Technology Behind Check Processing

Understanding the MICR line on a check is crucial for efficient check processing. The MICR line contains essential information encoded using magnetic ink. Let’s explore What Is MICR and How Does It Work?

What Is Micr And How Does It Work?

MICR stands for Magnetic Ink Character Recognition, a technology used to process checks by machines. It involves printing special characters using magnetic ink that can be easily read by magnetic scanners.

The Components Of The Micr Line

The MICR line typically consists of the check number, account number, and bank routing number. Each component is crucial for accurate and efficient check processing.

Tips For Avoiding Common Check-reading Errors

When reading a check, it is crucial to avoid common errors that could lead to financial issues or fraud. Here are some essential tips to help you navigate through the process smoothly:

Double-check The Numbers: Avoiding Financial Mistakes

Always verify the numerical amounts on the check to prevent errors. Ensure the written amount matches the numerical figures.

Be Cautious Of Altered Checks: Red Flags To Look Out For

Check for any signs of alterations or modifications on the check, such as overwritten numbers or smudges. Be vigilant for any irregularities.

Credit: www.53.com

Frequently Asked Questions

How Do I Read A Check?

To read a check, start by looking for the date, payee, and amount fields. Verify that the amount written out matches the numerical amount. Next, check the signature and make sure it matches the name of the account holder. Finally, look for any endorsements on the back of the check.

What Is The Routing Number On A Check?

The routing number on a check is a nine-digit code that identifies the bank or financial institution that issued the check. It is used to facilitate the transfer of funds between banks. The routing number is typically found on the bottom left corner of the check.

What Is The Account Number On A Check?

The account number on a check is a unique identifier that is assigned to the account by the bank. It is used to link the check to a specific account. The account number is typically found on the bottom right corner of the check.

How Do I Endorse A Check?

To endorse a check, sign your name on the back of the check in the designated endorsement area. If you are depositing the check, you can also include the phrase “for deposit only” to ensure that the funds are credited to your account.

Be sure to sign the check in the presence of a bank teller or notary public to prevent fraud.

Conclusion

Understanding how to read a check is crucial for financial awareness and security. By following the steps outlined, you can confidently navigate the information on a check. Remember to verify details for accuracy and protect your personal information. Reading checks effectively empowers you in managing your finances wisely.

If you’re wondering about Sam Sulek’s age, be sure to check out our detailed article: How Old is Sam Sulek? Unveiling the Mystery. Get the facts now!