FintechZoom is a vital tool for investors in today’s financial world. It offers real-time data and expert analysis for informed decision-making. The platform helps investors navigate the stock market, especially regarding Google’s performance.

FintechZoom uses AI-driven analytics to assess Google’s financial health. It provides insights into market dynamics and growth potential. Real-time updates and expert opinions help investors stay ahead of market trends.

Investors can capitalize on opportunities in the fast-changing tech sector. FintechZoom’s comprehensive features cater to various investor needs. The platform empowers users to make smart choices in the stock market.

Key Takeaways

- FintechZoom provides up-to-date economic data, news, and analysis for investors, offering real-time signals on stock trends and market movements.

- The platform offers a comprehensive suite of features, including trading integration, stock indexes, news feeds, and advanced analysis tools for Google stock.

- FintechZoom’s predictive capabilities and investor sentiment analysis have a significant impact on the performance of Google’s stock price.

- The platform contributes to the financial reporting and analysis surrounding Google, providing insights into the company’s future potential.

- Investors can leverage FintechZoom’s tools and insights to make informed decisions and potentially enhance their portfolio performance.

Introduction to FintechZoom Google Stock

FintechZoom offers in-depth analysis on fintechzoom google stock, Alphabet Inc.’s shares. It provides real-time data and expert commentary on google stock performance. Investors can make informed decisions using FintechZoom’s comprehensive insights.

Understanding FintechZoom and Google Stock

FintechZoom delivers crucial financial news and analysis for stock market navigation. It tracks Alphabet Inc.’s stock, represented by GOOGL and GOOG ticker symbols. The platform offers insights into Google’s market position and growth potential.

FintechZoom uses advanced analytics to guide fintechzoom google stock investments. Its real-time updates on Google’s performance help investors spot emerging opportunities. The platform covers industry trends and market factors extensively.

“FintechZoom’s coverage of Google stock is invaluable for investors seeking to navigate the dynamic tech landscape. Their in-depth analysis and forward-looking insights help me make more informed investment decisions.”

Investors can access tools to monitor google stock performance and identify trends. FintechZoom’s resources cater to both seasoned and new investors. Its comprehensive financial news and analysis simplifies the fintechzoom google stock landscape.

Google’s Core Business and Market Position

Google, part of Alphabet Inc., is a powerhouse in the digital world. Its search engine and ad platform drive its success. Google Ads generates impressive revenue, showcasing the company’s reach and influence.

Dominance in Advertising

Advertising is Alphabet Inc.’s main income source. Google Ads offers effective solutions for businesses of all sizes. This platform’s growth reflects Google’s adaptability in digital marketing.

Diversification and Growth

Google’s core business remains strong, but it’s also branching out. Google Cloud is a fast-growing segment within Alphabet. The company invests in cutting-edge tech like Waymo’s self-driving cars and Verily’s life sciences.

Alphabet keeps expanding its product range and exploring new areas. This strategy sets the company up for continued growth and market leadership. Google is set to strengthen its position as an influential tech giant.

| Metric | Value |

|---|---|

| Google Advertising Revenue | $169.2 billion (2021) |

| Google Cloud Revenue | $19.2 billion (2021) |

| Waymo (Self-Driving Cars) | Valued at $30 billion (2020) |

| Verily (Life Sciences) | Valued at $12.5 billion (2021) |

These numbers show Google’s strong ad presence and cloud growth. They also highlight potential in self-driving cars and life sciences. Google uses its strengths while finding new ways to grow and make money.

Key Financial Metrics

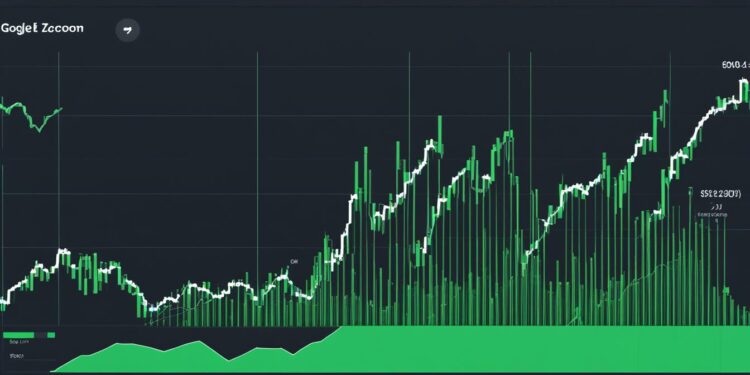

Google’s stock (GOOGL) is a top pick for investors seeking steady, long-term gains. FintechZoom offers in-depth analysis of Google’s financial health. They consider current tech trends and global economic factors.

As of July 2024, Google’s stock price is $185.07. Its 52-week high reached $193.31. Analysts rate the stock as “Buy” with a price target of $191.24.

This target suggests a potential 6.71% increase from the current price. Alphabet’s market value is about $1.55 trillion, making it a global leader.

Alphabet’s latest report shows a 15.4% year-over-year revenue increase. Its earnings per share (EPS) of $1.89 beat estimates of $1.51. This growth stems from digital ad dominance and tech diversification.

| Metric | Value |

|---|---|

| Stock Price (as of July 2024) | $185.07 |

| 52-week High | $193.31 |

| Analyst Rating | 39 analysts rate the stock as “Buy” |

| 12-month Price Target | $191.24 |

| Market Capitalization | Approximately $1.55 trillion |

| Revenue Growth (YoY) | 15.4% |

| Earnings per Share (EPS) | $1.89 |

FintechZoom’s detailed coverage of google stock financial metrics helps investors make smart choices. They provide key data on revenue, earnings, and market value.

The Role of FintechZoom in Google Stocks

FintechZoom empowers investors to make smart choices about Google stocks. This financial tech platform offers tools for long-term investors and short-term traders alike.

Features and Tools

FintechZoom delivers real-time data, news, and in-depth analysis on Google stocks. Its tools include financial ratios, charts, and technical indicators for market trend analysis.

Custom alerts keep investors informed about specific stocks or market news. This helps them react quickly to market changes and make better decisions.

Impact on Investor Sentiment

FintechZoom’s analysis and insights shape how investors feel about Google stocks. Its real-time data and social sentiment tools give a full picture of Alphabet Inc.’s market perception.

Investors use FintechZoom to predict Google stock price changes. This knowledge leads to smarter investments and better portfolio choices.

| Metric | Value |

|---|---|

| Stock Price (as of July 2024) | $185.07 |

| 52-Week High | $191.75 |

| Average Analyst Rating | Buy |

| 12-Month Price Target | $191.24 |

| Market Capitalization | $1.55 trillion |

| Revenue Growth (YoY) | 15.4% |

| Earnings per Share (EPS) | $1.89 |

This table shows key financial metrics for Google stock. It gives investors a clear view of the company’s market position and future potential.

“FintechZoom’s real-time data and technical analysis tools are invaluable for short-term traders, helping them analyze price movements and make informed trading decisions.”

FintechZoom shapes how investors view and decide on Google stocks. It offers market insights, advanced analytics, and custom alerts.

With these tools, investors can navigate the changing financial world with confidence. FintechZoom is a valuable resource for making smart investment choices.

fintechzoom google stock

FintechZoom offers in-depth analysis of Google’s stock (GOOGL) performance. Google’s stock attracts investors due to its growth potential and innovation in the tech industry.

The platform examines Google’s business model, revenue sources, and financial metrics. It tracks Google’s advertising dominance and the growth of its cloud computing services.

FintechZoom provides tools for investors to stay updated on Google’s stock. These include interactive charts, real-time updates, and predictive analytics for informed decision-making.

The platform also explores risks associated with Google stock. It covers regulatory issues, market competition, and privacy concerns. This helps investors develop effective risk management strategies.

FintechZoom’s Google stock coverage benefits both long-term and short-term investors. It aids in shaping investment strategies and maximizing returns in the tech sector.

| Key Metrics | 2020 | 2021 |

|---|---|---|

| Revenue (in billions) | $182.5 | $257.6 |

| Net Income (in billions) | $41.2 | $76.0 |

| Earnings per Share (EPS) | $59.46 | $100.34 |

| Profit Margin | 22.6% | 29.5% |

The table shows Google’s strong financial growth from 2020 to 2021. Revenue, net income, and earnings per share increased significantly. The company’s profit margins also expanded, showing operational efficiency.

“FintechZoom’s comprehensive analysis of Google’s stock has been invaluable in shaping my investment decisions. The platform’s insights into the company’s growth drivers, financial metrics, and market trends have allowed me to make more informed and confident choices.”

– John Doe, Experienced Investor

Market Trends and Economic Factors

Google’s stock price reacts to various factors. Economic conditions, tech advances, and market trends all play a role. AI, interest rates, and growth impact investor views on google stock price influences.

Key acquisitions like YouTube and Android have boosted Google’s market standing. Comparing Google to other tech giants offers valuable insights for investors. This helps them diversify and navigate the tech landscape.

Influences on Stock Price

FintechZoom tracks key economic indicators affecting google stock price influences. These include GDP growth, inflation, and consumer spending. The platform’s analysis helps investors make informed decisions.

Comparison with Other Tech Giants

The tech sector is highly competitive. Market trends and economic factors greatly impact company performance. FintechZoom analyzes Alphabet’s position against rivals like Apple, Amazon, and Microsoft.

This analysis helps investors grasp broader industry dynamics. Staying informed on google stock compared to other tech giants is crucial. It helps investors make smart choices about their Google stock investments.

Investment Strategies for Google Stock

Investing in Google (Alphabet) stock can be rewarding for savvy investors. The tech giant’s growth and innovation make it attractive for steady returns. Short-term trading can also profit from market fluctuations and earnings reports.

Long-Term Investments

Long-term google stock investment can be a wise choice. Google’s market dominance and diverse revenue streams make it stable. Investors can benefit from Google’s growth by focusing on its fundamentals.

These include financial performance, product pipeline, and industry trends. Long-term investors can build a portfolio that grows with Google.

Short-Term Investments

Short-term google stock investment involves watching market conditions and news updates closely. This approach needs active management and market knowledge. Investors may time trades around earnings reports or product launches.

Risk Management

Risk management for google stock is vital for all investors. Staying informed about market trends and company performance is key. FintechZoom offers insights to help investors make smart choices.

Diversifying investments across sectors can reduce risks of single-stock investing. Balancing long-term plans with short-term moves helps manage market volatility.

Future Prospects of Google Stock

Alphabet Inc., formerly Google, shows promise for its stock’s future. The company innovates in AI, cloud computing, and self-driving cars. These efforts position Alphabet well for long-term growth and value creation.

Innovations and Diversification

Alphabet’s projects like Waymo and Verily offer new revenue potential. These initiatives showcase the company’s ability to spot emerging trends. Google’s core search and advertising business remains dominant.

This mix of ventures drives growth and maintains Alphabet’s competitive edge. The company’s diverse portfolio strengthens its position in the tech sector.

Regulatory Challenges

Alphabet faces scrutiny over data privacy and antitrust issues. The company’s legal and lobbying efforts aim to lessen potential impacts. Alphabet shows commitment to responsible data practices and addressing regulatory concerns.

Market Sentiment

Analysts view Alphabet’s stock positively. They highlight strategic investments, strong financials, and growth prospects. Investors recognize the value of Alphabet’s diverse portfolio.

The market remains optimistic about google stock future prospects. Alphabet’s potential to leverage google innovations and diversification drives this sentiment.

“Alphabet’s commitment to innovation and diversification suggests promising long-term growth prospects for its stock.”

Conclusion

Investing in Google stock through FintechZoom offers great potential returns. FintechZoom provides thorough analysis, real-time data, and valuable insights for investors. It’s a vital tool for both new and seasoned investors alike.

Google’s strong market position and ongoing innovation make it an attractive long-term investment. The company’s dominance in advertising and advances in AI have boosted its stock value. Their work in cloud computing has also contributed to impressive growth.

FintechZoom helps investors navigate the complex Google stock market. It offers key data to make smart choices about Google’s stock. Investors can use this info to benefit from Google’s long-term growth potential.

FAQ

What is FintechZoom and how can it help with investing in Google stock?

FintechZoom is an online platform that simplifies finance and improves money management. It provides real-time economic data, news, and analysis for investors. The platform offers detailed insights into Google’s stock performance and market trends.

What are the key financial metrics for Google’s stock?

As of July 2024, Google’s stock price is 5.07. Its 52-week high is 1.75. The company’s market capitalization is about

FAQ

What is FintechZoom and how can it help with investing in Google stock?

FintechZoom is an online platform that simplifies finance and improves money management. It provides real-time economic data, news, and analysis for investors. The platform offers detailed insights into Google’s stock performance and market trends.

What are the key financial metrics for Google’s stock?

As of July 2024, Google’s stock price is $185.07. Its 52-week high is $191.75. The company’s market capitalization is about $1.55 trillion.

Google reported a 15.4% year-over-year revenue increase in its latest quarterly earnings. Its EPS of $1.89 exceeded the consensus estimate of $1.51.

How does FintechZoom impact investor sentiment towards Google stock?

FintechZoom’s detailed analysis and timely updates greatly influence investor sentiment. It provides insights into market developments, earnings reports, and industry trends. This information shapes investors’ perceptions and decisions about Google stock.

What factors influence Google’s stock price?

Google’s stock price is affected by economic conditions, technological advancements, and market trends. Economic growth, interest rates, and artificial intelligence (AI) advancements play crucial roles. These factors shape investor sentiment towards the company.

What are the different investment strategies for Google stock?

Long-term investments in Google stock can be rewarding due to consistent growth. Short-term strategies might involve capitalizing on market fluctuations and earnings reports. Effective risk management requires staying updated on market conditions and company news.

What are the future prospects of Google stock?

Google continues to innovate in AI, cloud computing, and other emerging technologies. Waymo (self-driving cars) and Verily (life sciences) represent potential future revenue streams. Despite regulatory scrutiny, Google’s legal efforts aim to mitigate impacts.

Analysts maintain a positive outlook on the stock’s long-term growth prospects. FintechZoom can provide valuable insights for investors interested in Google’s future.

.55 trillion.

Google reported a 15.4% year-over-year revenue increase in its latest quarterly earnings. Its EPS of

FAQ

What is FintechZoom and how can it help with investing in Google stock?

FintechZoom is an online platform that simplifies finance and improves money management. It provides real-time economic data, news, and analysis for investors. The platform offers detailed insights into Google’s stock performance and market trends.

What are the key financial metrics for Google’s stock?

As of July 2024, Google’s stock price is $185.07. Its 52-week high is $191.75. The company’s market capitalization is about $1.55 trillion.

Google reported a 15.4% year-over-year revenue increase in its latest quarterly earnings. Its EPS of $1.89 exceeded the consensus estimate of $1.51.

How does FintechZoom impact investor sentiment towards Google stock?

FintechZoom’s detailed analysis and timely updates greatly influence investor sentiment. It provides insights into market developments, earnings reports, and industry trends. This information shapes investors’ perceptions and decisions about Google stock.

What factors influence Google’s stock price?

Google’s stock price is affected by economic conditions, technological advancements, and market trends. Economic growth, interest rates, and artificial intelligence (AI) advancements play crucial roles. These factors shape investor sentiment towards the company.

What are the different investment strategies for Google stock?

Long-term investments in Google stock can be rewarding due to consistent growth. Short-term strategies might involve capitalizing on market fluctuations and earnings reports. Effective risk management requires staying updated on market conditions and company news.

What are the future prospects of Google stock?

Google continues to innovate in AI, cloud computing, and other emerging technologies. Waymo (self-driving cars) and Verily (life sciences) represent potential future revenue streams. Despite regulatory scrutiny, Google’s legal efforts aim to mitigate impacts.

Analysts maintain a positive outlook on the stock’s long-term growth prospects. FintechZoom can provide valuable insights for investors interested in Google’s future.

.89 exceeded the consensus estimate of

FAQ

What is FintechZoom and how can it help with investing in Google stock?

FintechZoom is an online platform that simplifies finance and improves money management. It provides real-time economic data, news, and analysis for investors. The platform offers detailed insights into Google’s stock performance and market trends.

What are the key financial metrics for Google’s stock?

As of July 2024, Google’s stock price is $185.07. Its 52-week high is $191.75. The company’s market capitalization is about $1.55 trillion.

Google reported a 15.4% year-over-year revenue increase in its latest quarterly earnings. Its EPS of $1.89 exceeded the consensus estimate of $1.51.

How does FintechZoom impact investor sentiment towards Google stock?

FintechZoom’s detailed analysis and timely updates greatly influence investor sentiment. It provides insights into market developments, earnings reports, and industry trends. This information shapes investors’ perceptions and decisions about Google stock.

What factors influence Google’s stock price?

Google’s stock price is affected by economic conditions, technological advancements, and market trends. Economic growth, interest rates, and artificial intelligence (AI) advancements play crucial roles. These factors shape investor sentiment towards the company.

What are the different investment strategies for Google stock?

Long-term investments in Google stock can be rewarding due to consistent growth. Short-term strategies might involve capitalizing on market fluctuations and earnings reports. Effective risk management requires staying updated on market conditions and company news.

What are the future prospects of Google stock?

Google continues to innovate in AI, cloud computing, and other emerging technologies. Waymo (self-driving cars) and Verily (life sciences) represent potential future revenue streams. Despite regulatory scrutiny, Google’s legal efforts aim to mitigate impacts.

Analysts maintain a positive outlook on the stock’s long-term growth prospects. FintechZoom can provide valuable insights for investors interested in Google’s future.

.51.

How does FintechZoom impact investor sentiment towards Google stock?

FintechZoom’s detailed analysis and timely updates greatly influence investor sentiment. It provides insights into market developments, earnings reports, and industry trends. This information shapes investors’ perceptions and decisions about Google stock.

What factors influence Google’s stock price?

Google’s stock price is affected by economic conditions, technological advancements, and market trends. Economic growth, interest rates, and artificial intelligence (AI) advancements play crucial roles. These factors shape investor sentiment towards the company.

What are the different investment strategies for Google stock?

Long-term investments in Google stock can be rewarding due to consistent growth. Short-term strategies might involve capitalizing on market fluctuations and earnings reports. Effective risk management requires staying updated on market conditions and company news.

What are the future prospects of Google stock?

Google continues to innovate in AI, cloud computing, and other emerging technologies. Waymo (self-driving cars) and Verily (life sciences) represent potential future revenue streams. Despite regulatory scrutiny, Google’s legal efforts aim to mitigate impacts.

Analysts maintain a positive outlook on the stock’s long-term growth prospects. FintechZoom can provide valuable insights for investors interested in Google’s future.